What is evolving in chemical management around the world

Fueled by technological advances and innovation, chemical management is evolving. Did you know that Europe and Asia are leading the way in chemical regulation?

Chemical management is an evolving topic within Environment, Health & Safety (EHS). Fueled by technological advances and innovation, new chemicals are constantly being introduced into commerce. When a new chemical enters the market, it must undergo rigorous classification requirements, safety data sheets must be created, and restrictions on how the chemical can be used are enforced. Below is some insight into trends in chemical regulation from August 2019 to August 2020.

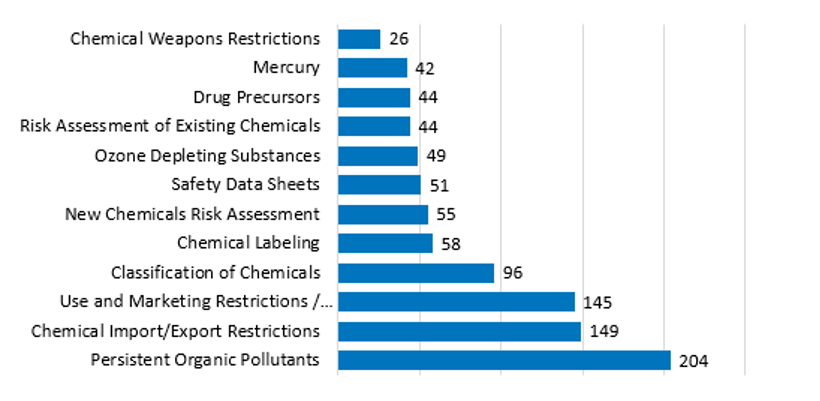

Trends in the highly regulated use of chemicals

As you can see in the graph below, the categories within chemical management that show the most action (e.g. proposed and final regulations, guidance, policies and other developments) this past year are Persistent Organic Pollutants, Chemical Import/Export Restrictions and Use and Marketing Restrictions. One reason that POPs shows up as the leading category is that European Commission amended the POPs and PIC Regulations which impacts all EU member states and thus numerical trends at the international level. The POPs and the PIC Regulation establish respectively restrictions on the production, use and marketing of POPs and on the import and export of hazardous chemicals.

Chemical Topics (August 2019 – August 2020)

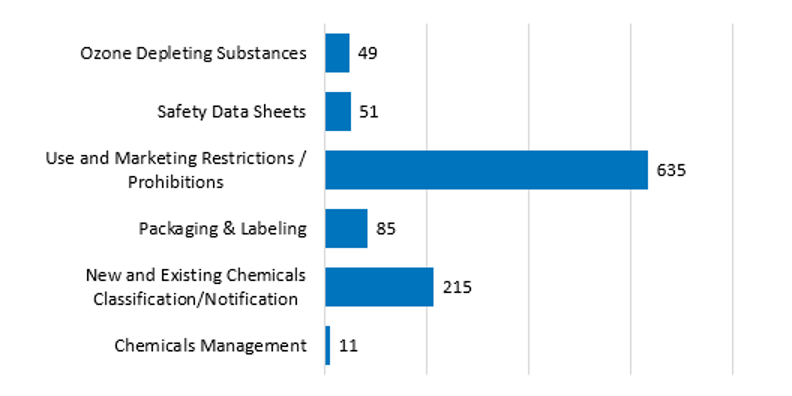

When grouped more broadly, the main category is Use and Marketing Restrictions (which includes the above top two categories of POPs and restrictions on import/export).

Chemical Topics/Broader Categories (August 2019- August 2020)

What does this mean? There were a significant number of regulatory and policy developments that involved placing chemicals into the market. This includes restrictions for international companies (such as prior informed consent) when importing chemicals or exporting them to their global sites.

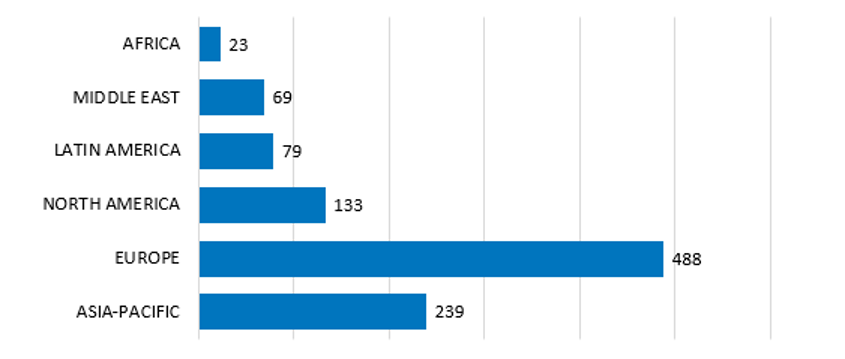

Europe and Asia are at the forefront of chemical regulation

Over the past year, Europe and Asia had the most activity for chemicals management.

Chemical Management Across the Globe (August 2019-August 2020)

This should come as no surprise, as Europe has long implemented a comprehensive system to regulate chemicals (e.g. EU’s REACH). Similarly, Asia’s emphasis on chemical regulation was evident as early as 2016 and, as seen in this trends report, is continuing to be an active area of regulation.

It is worth noting that with the new Toxic Substances Control Act (TSCA) in the United States, companies should expect to see a steady stream of new developments and that may impact North American numbers moving forward.

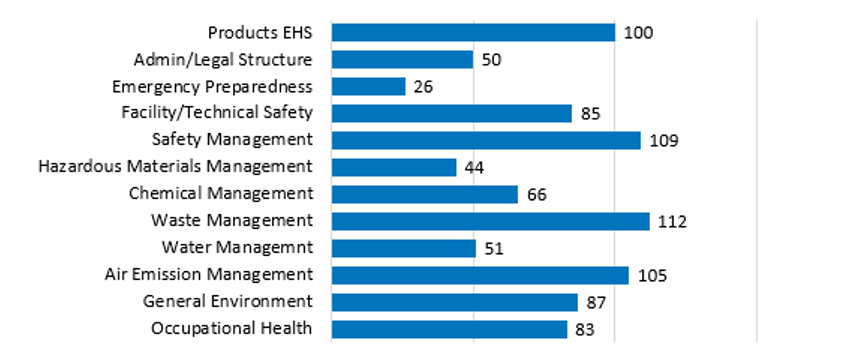

If we dive deeper into Europe, it becomes apparent that chemical management is the second most active category of regulatory and policy developments over the last year. Let’s find out why!

Activity in Europe – chemical regulation continues to be at the forefront

The biggest trends at EU level are the identification of further substances of very high concern (SVHC), which can be followed by their inclusion on the authorisation list, and restrictions on the manufacture/use of hazardous substances. These restrictions are justified by the fact that they restrict chemicals that are hazardous to human health or the environment. The European Chemicals Agency (ECHA) updates the candidate list 2 a year (usually July/January). The inclusion of further substances in the authorisation list is not that common (there are currently 54 listed substances).

Another hot topic at EU level is the classification and labelling of substances. Member States continue to identify further substances for inclusion in the Classification, Labelling and Packaging (CLP) Regulation EC/1272/2008 Regulation. As a rule, the Commission adds further substances to the list of substances subject to EU harmonised classification and labelling criteria once a year.

An EU development that will impact almost all companies placing hazardous mixtures into the EU market is the need to provide emergency health information to bodies appointed by Member States. In addition, companies must create a new unique formula identified (UFI) for the mixtures and display it on their label. Companies will have to comply with this as of 1 January 2021 (mixtures for professional or consumer use) or as of 1 January 2024 (mixtures for industrial use).

The EU also had some developments on nanoforms, as companies must submit further information to ECHA when registering them.

A new chemicals strategy from the European Commission

The European Commission published its new chemicals strategy on October 14. Interested companies should refer to this strategy when looking forward. The priorities for the upcoming years are similar to the current ones. There will also be new provisions regarding nanoforms. The Commission aims to streamline chemicals assessment procedures and restrict the use of hazardous chemicals in further products.

Activity in Asia: chemicals are gaining importance

In Asia, chemicals are gaining importance. If you compare the placement of chemical management in the graph from this past year with 4 years ago, you will see that chemical regulation is indeed becoming more relevant to the Asian market and the businesses who work in that market.

Asian Trends (August 2019-August 2020)

Asian Trends (August 2015-August 2016)

In Chinese speaking jurisdictions, there are three main reasons why we may be seeing this trend:

- Domestic law continues to adopt chemical/product management on POPs and Mercury to align with the international convention;

- Production safety management (including storage, transport, and manufacturing) is a major policy and enforcement focus in China, among other types of production activities;

- APCP countries like China and Taiwan are reforming the chemical registration procedure to streamline the process, which can benefit companies from a global trade perspective.

Key takeaways

- Chemical regulation is a trending topic globally, but particularly in Europe and Asia-Pacific

- Companies that use or market chemicals should keep a close eye on evolving regulations

- Even though the US is not highlighted in these graphs, companies with operations in the US should be aware of increased activity based on the Toxic Substances Control Act (TSCA).